At the forefront of tax, legal, and accounting, Deloitte is a professional services powerhouse that supports organizations, from the Global 500 to private businesses, to navigate the tumultuous international landscape and build better futures.

In the run up to AmCham Greece’s much anticipated 20th Athens Tax Forum, Deloitte Greece professionals talk to Business Partners magazine to share their thoughts on how Deloitte is supporting successful business growth, the impact of GenAI on legal departments, and the importance of building trust in creating an efficient tax system.

Building Trust: How Increased Tax Audits Highlight the Need for Transparency and Fairness

By Efstathios Bakalis, Partner, Head of Tax Controversy and Tax Litigation, Deloitte

As the number of tax audits conducted by the Tax Administration continues to rise, demand for stable conditions and transparent processes is also growing.

Trust between the Tax Administration and taxpayers is crucial, serving as a key measure of the administration’s quality and efficiency. A stable taxation environment and transparency are essential to achieving this. To address these concerns, several practical measures could be implemented to ensure the fair and efficient execution of tax audits—steps that would also help taxpayers feel that they are being treated justly. Key initiatives include:

- Adhering to Supreme Court decisions: Tax audits should consistently apply the Supreme Court’s legal resolutions in all similar cases. Once the Supreme Court has made a definitive ruling, there should be no room for alternative interpretations. The Tax Administration should automatically and immediately consider these legal decisions without waiting for an official circular to be issued.

- Timely interpretation of new tax laws: The Tax Administration needs to provide clear and direct guidance soon after new tax legislation is enacted. This allows taxpayers to comply from the beginning, reduces subjective and arbitrary interpretations by tax officials, and ensures consistency across the administration.

- Consistent treatment across audits: Differing approaches to similar issues by various tax units can lead to unfairness and instability for taxpayers. By using statistical data and analytics, the central monitoring of audits can identify discrepancies and establish guidelines to ensure uniform treatment.

- Detailed justification of audit findings: For audit conclusions to be credible, they must thoroughly cover all aspects of the case, including the factual background, legal interpretation and the audited party’s arguments. This comprehensive approach helps the audited party understand the rationale behind the tax assessment and whether it is reasonable to contest it. It also provides a solid basis for the Dispute Resolution Directorate and Administrative Courts to adjudicate the case.

These measures are grounded in common sense and can swiftly foster a better relationship between the Tax Administration and taxpayers. The expected outcome is straightforward: Fewer cases brought before the courts will signal a fairer and more efficient Tax Administration. By implementing these initiatives, the Tax Administration can enhance its credibility, ensure fairness in tax audits and build stronger trust with taxpayers.

Revolutionizing the Future: How Deloitte Is Transforming Finance, Tax, and Accounting

By Konstantinos Motsakos, Partner, Finance & Payroll Operate Leader, Business Process Solutions, Deloitte

In today’s rapidly evolving business environment, the finance, tax, and accounting areas are undergoing significant transformations driven by technological advancements, tax changes, and increasing management needs.

As rapid technological developments and legislative changes drive considerable shifts across finance, tax, and accounting, Deloitte plays a vital role in assisting organizations in navigating these challenges by highlighting specific transformative use cases within these domains.

FINANCE

A notable use case in the area of finance involves the implementation of AI-powered predictive analytics to enhance financial forecasting. For example, a multinational corporation partnered with Deloitte to integrate AI tools that analyze historical data and current market trends, resulting in a 20% improvement in forecasting accuracy. This aligns with the findings of Deloitte’s Finance Survey 2023, which indicates that companies using AI in finance report forecast improvements of up to 20-30%.

Additionally, another organization utilized robotic process automation (RPA) to automate its accounts payable process. This automation reduced processing time by 50% and minimized human errors, as highlighted in Deloitte’s Global RPA Report.

TAX

In the area of tax, many organizations worked with Deloitte to implement automation-as-a-service solutions for managing tax compliance activities, such as preparation of monthly tax returns, myData reconciliations, preparation of tax declarations per property and real estate reconciliations. By implementing this technology, the company achieved real time tracking of tax obligations and streamlined its reporting processes. This reflects trends from Deloitte’s Global Tax Survey, which shows that 60% of companies see efficiency gains from automation in tax management.

Another organization employed an AI-driven tax platform to summarize the tax legislation, reducing human effort by 15%.

Obviously, to respond effectively to increasingly complex changes, tax departments will need both access to accurate and timely tax-related data and the ability to work with tax teams that have data management and technology expertise. One of the key insights in the 2023 Tax Transformation Trends Survey is that outsourcing is a prime strategy to access technology capabilities: “Outsourcing has long been recognized as a tool for increasing efficiency, but access to technology tools is now an even more important driver. Respondents cited access to the latest technology capabilities (54%) even more often than reduced operating costs (51%) as a major or significant benefit of outsourcing an entire activity or function in the tax department. Reduced need for capital investment in technology (45%) was also named as an important benefit.”

ACCOUNTING

In accounting, Deloitte assisted a major airline firm in implementing an extract transform loading (ETL) tool, which automated the matching of transactions with credit cards and bank statements. This resulted in a 60% reduction in reconciliation time and a significant decrease in errors.

Furthermore, Deloitte supported an international retail company in deploying RPA and ETL tools to enhance their management reporting accuracy. That automation mechanism automatically detected discrepancies and potential errors in management reports, leading to a 30% improvement in reporting reliability and freeing the accounting team to focus on strategic analysis, thus enabling management to make more informed decisions.

With the growing importance of environmental, social, and governance (ESG) reporting, another enterprise expanded its accounting focus to include non-financial metrics.

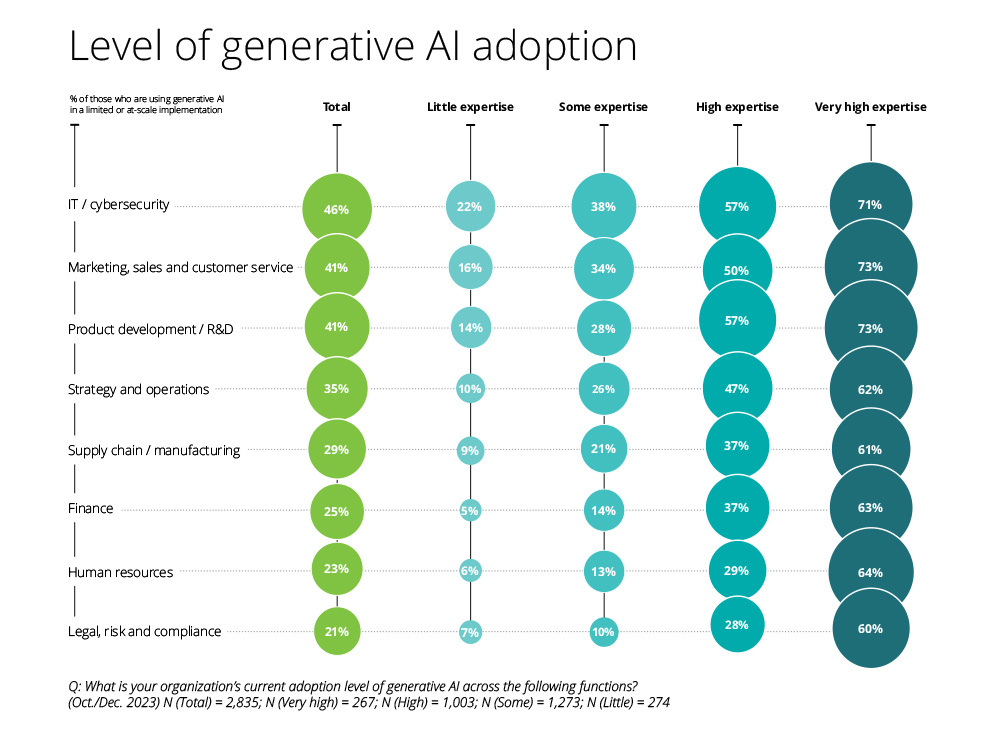

Organizations that cited very high generative AI expertise were already taking a much more comprehensive approach than average, with significantly higher adoption levels across a broad range of functional areas. In specific areas such as HR, legal, risk, and compliance, those organizations’ generative AI adoption rates were nearly three times higher than for the total respondent pool (figure 1) in Deloitte’s State of Generative AI in the Enterprise report, Q1 2024.

In summary, finance, tax, and accounting sectors are being reshaped by technological advancements and strategic solutions provided by Deloitte. By adopting cutting edge technologies such as AI, automation, and machine learning, organizations can significantly boost efficiency, accuracy, and compliance. Embracing these innovations positions businesses to better overcome challenges and capitalize on new opportunities, ensuring sustainable growth and competitiveness in an ever-evolving market landscape.

Technology is having, and will continue to have, an impact on the finance, tax, and accounting professions. The magnitude, timing and types of impact can be debated. As professionals, there are four things we can do in 2024 to appropriately consider the impact of this new technology on our profession:

- Educate ourselves on the domain by reading articles, attending webinars, and so on. This is a rapidly changing field, so it may be impossible to stay completely up to date, but it is worth engaging with key updates. Use this to develop a view of what technology could mean for the finance, tax, and accounting activities you undertake or lead.

- Reflect on use cases and where the most value can be added.

- Experiment with new technology solutions, noting their limitations.

- Keep an open mind to the positive effect that technology could have on the productivity of the next generation of professionals.

- Assess your data and infrastructure readiness to adopt new technologies.

Efficiency and Innovation: How GenAI Is Transforming Legal Departments

By Maria-Alexandra Papoutsi, Managing Associate, AI & Legal Function Transformation, KBVL Law Firm, Member of Deloitte Legal Network

Synonymous with business transformation and innovation, Generative AI is a big trend of our times. But is it worth the hype? And (how) are legal departments impacted by this technology?

All predictions indicate that GenAI is set to disrupt the legal industry, much as typography once did, by significantly enhancing efficiency, accuracy, and innovation in everyday legal tasks. This piece examines the risks and benefits of GenAI transformation for legal, traditionally one of the most old-fashioned departments in any organization.

Most general counsels with a medium-sized, or larger, in-house legal team (six to eight lawyers in Greek market terms) would agree on the most common challenges their team faces today: increasing workloads, pressure to reduce costs, and the need to respond faster; lots of time spent on mundane non-legal tasks, such as reviewing large e-mail threads and attachments, managing projects, and checking reminders and deadlines; and difficulty keeping up to date with new legislation and jurisprudence or implementing regulatory compliance.

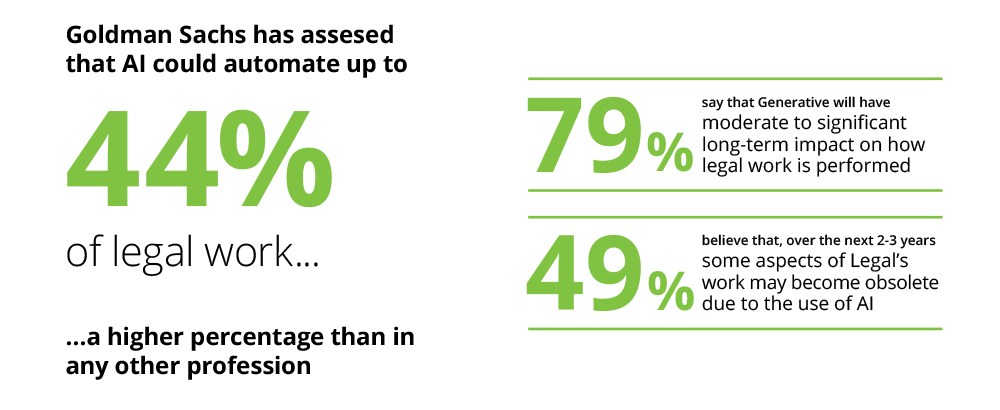

AI has the potential to automate up to 44% of legal tasks, assisting legal departments with their text-heavy tasks, such as reviewing, drafting, summarizing, or comparing documents, including contracts, minutes, memos, policies etc. GenAI, with its superior, human-like understanding of the deeper meaning and correlation of (legal) terms, has truly strengthened such predictions.

A plethora of once unimaginable efficiency possibilities is now wide open for legal departments of any size and shape. Key use cases include:

- Legal document drafting: Creating the first draft of a legal document, such as a contract or memo, based on specific legal scenarios or a given set of parameters. This saves time while inspiring the necessary creativity when this is missing.

- Commercial contracting: Identifying the most likely median end position for a particular clause, in a particular contract type, to speed up the negotiation process. This helps deliver business value and increases speed to market.

- M&A: Conducting faster due diligence across significantly larger data sets, increasing the accuracy of target valuations. This reduces business risk and increases business intelligence.

- Regulatory compliance: Conducting regulatory gap analysis (e.g. by comparing two or more areas of legislation or by comparing new regulatory requirements against existing legal documents that must be revised) and assessing the impact of the differences. This speeds up manual and time consuming processes and increases accuracy.

- Legal research and knowledge management: Generation of updates, legislation summaries and briefings for the business and the lawyers, generation of training materials, interrogation of knowledge assets. This reduces risk and upskills teams.

Each legal department must consider its own needs and priorities while identifying suitable tasks for GenAI transformation. Critical factors to consider include demand and feasibility, including volume and value of examined tasks, current human effort to produce an output, future human effort to validate AI results, and alignment of priorities with wider organization strategy.

Foreseeing and addressing in time, AI risks related to, for example, data privacy/security, intellectual property, liability, AI regulation, bias, and AI-generated errors, namely “hallucinations”, should always be part of any GenAI transformation strategy, irrespective of the department or organization concerned, in order to make sure the risks do not outweigh the benefits.

Success in GenAI transformation depends on how effectively end users interact with this new technology. As GenAI moves from inflated expectations to harsh disillusionment, it becomes clear that human intelligence is needed in order for AI to produce quality results.

The active coding language for using GenAI applications is natural human language—initially English, now also Greek and others with increasingly better results. How would you ask an intern on their first day at work to summarize a given legislation? Would you specify the format, the maximum length, the style of writing, the purpose of use, and the audience? After the first draft, if you are not entirely happy with the result, would you give specific feedback on what they did well and what should they change? Similarly, when conversing with GenAI applications to get assistance in a task, legal teams also need to take such considerations into account. These will help them formulate an effective task request (prompt), which will then ensure the best GenAI responses (output).

Legal prompting is the respective art and science of crafting effective legal task prompts in order to elicit customized GenAI output and has the potential to make a huge difference in quality, as well as overall user experience. Lawyers are considered to be among the most talented users of natural language, so legal prompting should come more naturally.

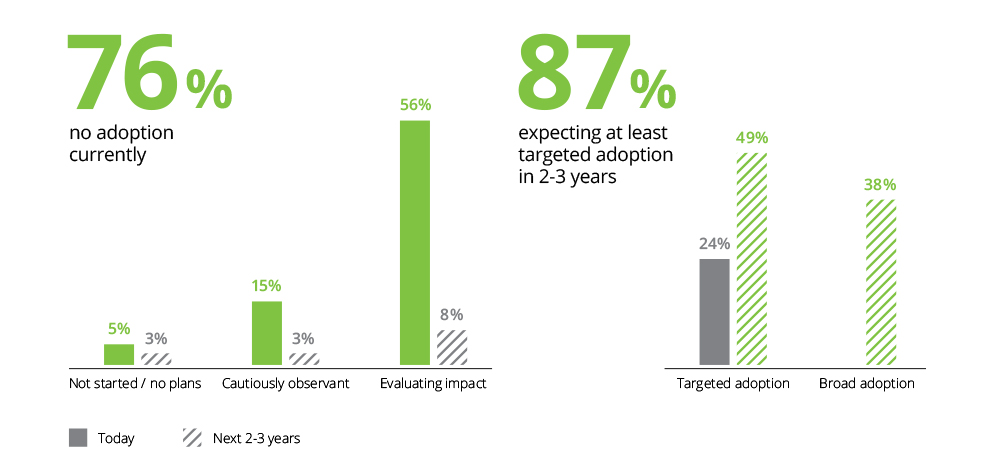

Since November 2022, GenAI has driven unprecedented business transformation. Several predictions suggest that within less than four years, AI’s capabilities will resemble those of an average lawyer. Given such predictions, it seems that now the greater risk is not to implement AI solutions, thus missing the wave of evolution. Legal departments must instead carefully plan their AI strategy as soon as possible, incentivize AI adoption across their teams, provide upskilling opportunities, especially to older colleagues, and be prepared for bold organizational decisions.