The COVID-19 pandemic that broke out at the beginning of 2020 triggered a global economic slowdown affecting trade, investment, growth, and employment in a major way. SMEs and startups, as key players in the global landscape (they represent 90 percent of businesses and more than 50 percent of employment according to the World Bank), also took a big hit.

The American-Hellenic Chamber of Commerce, swiftly responding to the crisis, has launched a discussion on the anticipated economic fallout, which is expected to be immense. And although forecasts suggest that a large number of SMEs and startups worldwide will not survive this crisis, it is in our common interest to make available the right tools to help them get through this.

In this issue of Business Partners, in line with AmCham’s latest session in the Digital Talks and Events series, we invite industry leaders to assess the current situation, evaluate the likely consequences of this crisis for SMEs and startups, and share their thoughts on the necessary actions to be taken moving forward.

“Together with the Ministry of Finance, we have deployed a palette of measures so that almost all SMEs will be benefitted. Starting from the repayable advances from the Ministry of Finance and coming to measures issued by the Ministry of Development such as the co-financed loans with interest subsidy, the interest subsidy of all business loans for three months, and as of today the new SME loan guarantee fund. […] We are building a network of measures specifically for innovative startups in Greece.”*

— Yannis Tsakiris, Deputy Minister of Development and Investments*From #AmChamIdeas Series “Startups and SMEs: Challenges and Opportunities to Overcome the COVID-19 Crisis” which took place on June 3 as part of the AmChamGR Digital Talks and Events series

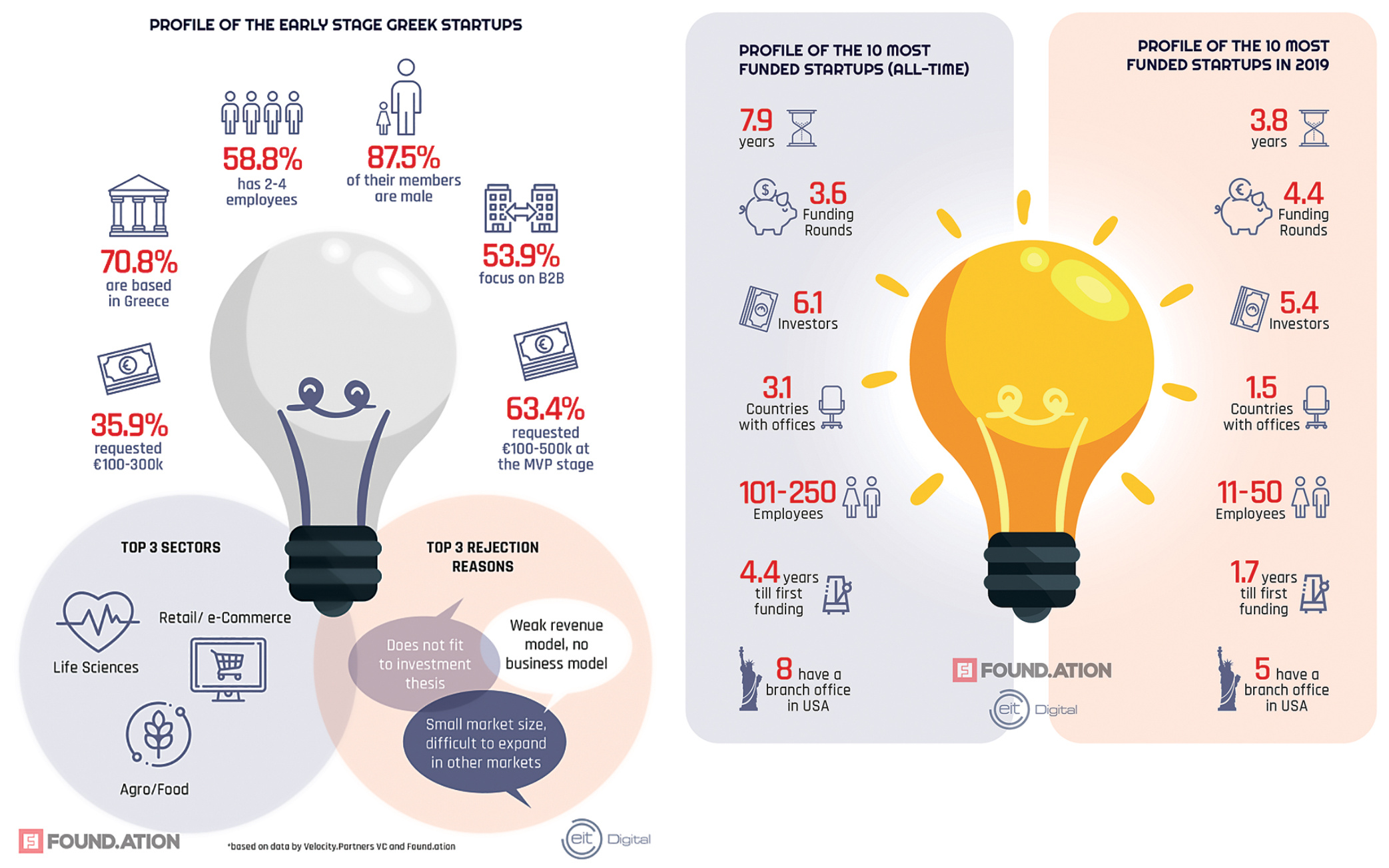

Source: “Startups in Greece 2019: Re-mapping the investment landscape,” an annual report by Found.ation and EIT Digital in partnership with Velocity.Partners VC

Startups and SMEs: Challenges and Prospects Post-COVID-19

By Litsa Panayotopoulos, Chair of the Education, Innovation and Entrepreneurship (EIE) Committee, the American-Hellenic Chamber of Commerce

According to a 2017 Eurostat report, startups and SMEs constitute upwards of 99.5% of businesses in Europe and account for approximately two thirds of total employment. In this context, the European Business Angels Network (EBAN) and the Hellenic Business Angels Network (HeBAN) have expressed their concern on the impact of the ongoing coronavirus crisis on Europe’s startup and innovation ecosystem, particularly in terms of liquidity, the reduced investment capacity of business angels and the need to make often drastic adjustments to adapt to the new reality.

The Greek diaspora could yet prove to be an important factor in reigniting the country’s startup ecosystem; the international business angel community could be another

The pandemic has also slowed down the growth of Greece’s relatively small entrepreneurial ecosystem, which had in recent years evolved into an attractive investment destination with numerous promising tech and software startups that will form that basis for Greece’s new growth model. While uncertainty will certainly slow down domestic funding procedures,the Greek diaspora could yet prove to be an important factor in reigniting the country’s startup ecosystem; the international business angel community could be another.

Greece needs a robust revitalization strategy for startups and SMEs that will define the necessary means and procedures to ensure a swift exit from the current situation. Funding and support agencies, including private sector investors, will have to play a key role in this recovery, working alongside regional and local government authorities throughout the country to support innovation and entrepreneurship, small companies as well as individuals with extraordinary ideas and the drive to evolve and excel, creating more jobs as they do so.

Turning Crisis into Opportunity

By Prof. Panayiotis H. Ketikidis, Vice Principal of Research and Innovation at City College, University of Sheffield; Chairman, South East European Research Center (SEERC); Founder, International Conference of Entrepreneurship Innovation and Regional Development (ICEIRD)

The COVID-19 pandemic has caused unprecedented disruption to all areas of political, social and economic life worldwide. In Greece, SMEs and startups, which have been a key part of the economy in recent years, have come under extreme pressure, to the extent that the very existence of many companies is now at stake.

The Greek government must fully appreciate how public funds can deliver more efficient support for SMEs with the help of business angels

Yet while the Greek economy was not prepared for such sudden disruption, the crisis has given the country the chance to reassess the current system’s insufficiencies and initiate the necessary steps for remedies and reforms.

SMEs and startups, beyond merely ensuring their survival by securing liquidity, cutting costs and focusing on their core competences, need to re-evaluate and adapt their business models in relation to both the existing constraints and the new opportunities that are arising in the post-COVID-19 era. Thus, the crisis has given innovative entrepreneurs the chance to seek bigger and new market share while implementing the resilience concepts necessary to face any future crises.

Greece, in recent years, has developed into an attractive investment destination in a variety of business sectors, and the Greek government must fully appreciate how public funds can deliver more efficient support for startups with the help of business angels. Business angels bring smart money, knowledge, experience and a network to startups and help them to scale up. Co-investment schemes with business angels have proven to be an efficient way to attract new money in many countries, and they also add value for public authorities, compared to grants, because their leverage effect is higher.

Supporting Startups Through the Crisis: Loans, Investments and Intellectual Property

By Peter Cowley, Serial Entrepreneur, Angel Investor, President of the European Business Angel Network (EBAN)

The European Business Angel Network (EBAN) represents the early stage investment ecosystem in Europe and many other countries. As a trade body, we have both approached the European Union directly and helped our members approach their own governments with information that underlines the need to strongly support early stage startups in the same way that governments currently support later stage businesses.

Commonly, early stage companies do not have enough income from customers to break even while developing technology and markets, and hence rely on business angels and other investors. That being the case, government schemes that generally protect jobs need to be adapted and extended to also support and protect intellectual property. In early stage companies, that intellectual property is still under development and includes technology, possibly patents, teams, brand, and customer base.

The survival of early stage companies is paramount—if they fail, teams will dissipate and intellectual property will be lost

In the United Kingdom, support for the commercial sector has been provided by means of a furlough scheme that covers 80% of the wages of approximately nine million workers, who are then not allowed to work while furloughed, and is mainly used for service industries such as hospitality and retail. Technology product companies, which represent approximately 95% of angel backed startups, need to continue to develop their intellectual property and hence cannot use the furlough scheme. Loans are available for companies from a single to over 100,000 employees, but these, by definition, need paying back. Government grants for innovative companies have increased both in volume and in size, and these are extremely useful for startups.

The United Kingdom has also set up the Future Fund, which provides government money as a co-investment with angels and VCs. In order to avoid discussion of valuations in these very uncertain times, this is via an interest-bearing convertible loan at a discount to a later investment round. There has been significant takeup, mainly with VCs as co-investment partners.

There are similar wage-support and loan schemes throughout Europe, and some countries have equity schemes. Business angels must help their portfolios with assistance—it is more likely than an investor will have experienced downturns and other crises than early stage founders—and with more money as equity.

It is critical for companies to understand that “cash is king” and for governments to provide finance either directly to companies or via business angels and other investors. It is also critical to support employees, who are probably working from home, sometimes in difficult situations due to lack of space and simultaneously caring for small children.

In conclusion, the survival of early stage companies is paramount—if they fail, teams will dissipate and intellectual property will be lost. And the way to ensure their survival is to provide cash via equity and grants, not repayable debt.

Entrepreneurs are always risk takers, willing to learn and adapt; given appropriate support from governments, most early stage companies will survive this crisis.

How Can Startups Survive COVID? Embrace Customers

By Dr. Ronald F.E. Weissman, Chairman, Software Group, Band of Angels; Member of the Board, Angel Capital Association

COVID-19: a worldwide pandemic for startups as well as people. Over 50% of startups have seen revenues plunge by more than 20%, while 41% of global startups have less than three months of cash and 65% have less than six months.1 India, the United Kingdom and the Middle East have given similar dire warnings.

If customers think you offer real value, they will find ways to support you

While investors worldwide say we’re “open for business,” many focus on portfolio companies or are waiting for better deals later in the year. While government funding can provide some relief, it is temporary and scarce. Successful startups deal directly with cash-flow problems, particularly those in less developed ecosystems, such as Greece.

During previous crises, survivors preserved cash by focusing on core activities and fast expense reduction. And they stayed close to their customers. If customers think you offer real value, they will find ways to support you.

Now is the time to embrace customers.

- Encourage customer-driven design: Involve customers in design early. Form product advisory boards. Start early access programs. Steve Jobs was a master at making “ADBO” (advisory board) members think they designed the product. Result: They bought and bought. Some will even pay you to give you product advice via early access. Explore joint development agreements (JDA) where customers pre-pay and pre-buy products they help design.

- Turn products into services: Help customers gain product value. Train users on how to achieve customer business goals, not just GUI button pushing. Some companies derive over a quarter of revenues from services helping solve business problems.

- Understand that selling is more than your product. Understand how you can solve the customer’s top problems. Map your product to their issues. Naïve companies push products. Smart companies sell solutions. In today’s climate, you have no chance of selling if you’re not solving one of their top problems.

- Speed up the sales cycle. Use technology to make onboarding faster and enable products to be sold, installed and supported remotely, without a site visit and or extensive custom engineering. You may have a best in class product, but if you’re last-in-class in usability, you may lose the deal.

- Be creative with pricing and contracts. If customers need lower pricing, offer a SaaS-like contract. Any product can be delivered via a subscription, even tractors. If customers want to reduce perpetual SaaS charges, offer a traditional contract. Modularize and sell something basic that solves core problems — start somewhere, land and expand. Avoid “all or nothing” deals. Find out how customers want to buy. Explore risk-sharing contracts where customers can bundle your product with theirs and can choose how much to pay up-front versus paying royalties. Be flexible, understand deals from the customer’s perspective. True partnership is a win-win. Collaboration is much more than a narrow, buyer-seller relationship.

Customers remember who had a customer-first attitude, who went beyond the minimum level of support, and who was there when they needed you. Embracing customers will help you survive now and thrive later.

1 Startup Genome, “The Impact of COVID-19 on Global Startup Ecosystems,” April 2020.

The Case for Meritocracy

By Dimitris Tsingos, Founder, Starttech Ventures

While many have called the COVID-19 pandemic “unexpected,” experts have long warned the international community about this kind of threat. Much like with earthquakes, it seems that our inability to predict the exact timing of such events creates a kind of illusion that they will never happen. Yet the last six months have shown us that they absolutely do.

The economic impact of the COVID-19 pandemic is devastating. Unemployment in the U.S. reached the highest level since the Great Depression, China recorded its first negative quarter in decades, and many leading economies are facing the impact of lockdowns and other measures. In Greece, a country that has essentially been in permanent crisis since 2009 the situation is particularly difficult.

Meritocracy is a key element of success in entrepreneurship ecosystems and subsidies very rarely contribute to having more of it

Greece’s economic exposure to tourism is huge, with the sector accounting for almost 20% of the GDP. Yet despite considerable efforts from the state and industry stakeholders, the country’s tourism income is expected to shrink by 75% or more.

Yet while the real economy is clearly in bad shape, financial markets do not seem to be affected by the pandemic. Looking at the stock, PE/VC and M&A markets, the pattern is evident: After an initial shake-up in March, when the pandemic accelerated in the U.S., investors seem to have regained confidence.

So, what about startups and the early stage investment ecosystem? Though many think that the state should intervene with support packages, there is little evidence that this makes sense. From a startup perspective, the number of companies that have been positively affected by the pandemic is likely higher than those who were negatively affected. This is simply because most startups work in digitalization and there’s no time better for a company offering digitization solutions than during a lockdown. Companies doing e-commerce, e-learning, e-collaboration, e-everything, are thriving and enjoying unprecedented growth in the healthiest way of all: based on revenues.

On the other hand, deep tech startups, those developing groundbreaking technologies and other scientific/technological breakthroughs, are by definition unaffected by shortterm demand fluctuations as their products are not yet ready. Deep tech startups are often well funded and prepared to work for several years before having their first paying customer.

The third category of startups are in a kind of a limbo state: lacking sufficient capital, technical innovation and an efficient business model that could support organic growth in times of crisis. Unable to find investors or customers, these startups might indeed face an existential threat. The question is whether these startups should exist in the first place. Don’t we often witness the creation of solution-looking-for-a-problem companies, made possible through an abundance of available capital (mostly state subsidies)?

The next couple of years will be very tough for millions of people around the world. Whole industries (e.g. airlines) face serious challenges, with unprecedented layoffs already taking place. We must create a safety net for this large number of people, making sure that our social fabric is preserved. It is my humble opinion that our precious taxpayer money would be better used in this good cause than supporting startups that shouldn’t even exist in the first place. Meritocracy is a key element of success in entrepreneurship ecosystems and subsidies very rarely contribute to having more of it. Quality startups not only will survive the coronavirus crisis but will also thrive in it. Let’s use our society’s resources to support those who are truly in need.